Back to List

Back to List

New Jersey Pharmacy Gets the Perfect Prescription from Biz2Credit

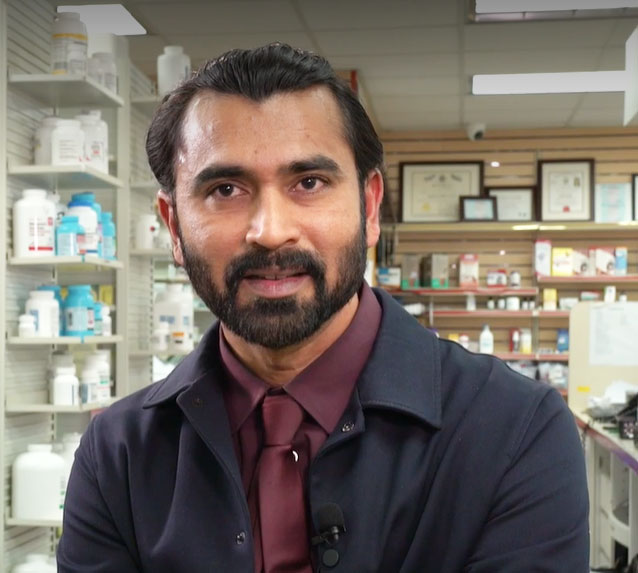

Scotch Plains Pharmacy had been a long-standing pillar of the local community and had garnered a history of respect and prestige. Gandhi knew this and was able to identify that there was an incredible business opportunity that he could not pass up. The only obstacle in his way was securing the necessary funds to make the acquisition. That is when Biz2Credit came into the picture.

The independent pharmacy industry is one full of opportunities for those that have the will to learn the necessary rules and regulations that accompany the field. According to the National Community Pharmacist Association (NCPA), there are over 22,000 independent pharmacies in the United States. Of that, approximately 26% of pharmacy owners own two or more pharmacy store locations, a testament to the health of the industry, despite the encroachment of the national chain stores.

"My favorite part about running a pharmacy is being able to give my customers and patients advice that will help them improve their health. I really enjoy talking to them and it makes me happy when they follow my instructions and then see positive improvements in their life."

Once Gandhi identified that he would need additional funding to acquire the pharmacy, he began to look at the different types of institutions that would be able to assist him. Due to the time-sensitive nature of the pending acquisition, it was important to him that the organization he chose would be able to get him the funds that he needed quickly. Once Gandhi researched several different institutions, he realized that Biz2Credit was the best option to help him with business acquisition financing and decided to reach out. After speaking with one of Biz2Credit’s in-house funding specialists, Gandhi made the decision to apply for financing with Biz2Credit. He recalls a streamlined and speedy process that allowed him to get funds into his bank account in a timely manner.

"The process to apply and get approved for the funding was simple, and that’s because Biz2Credit made it that way. They asked for the necessary application documents, and after that we were approved for the financing very quickly."

With the turnaround time being so quick, Gandhi was able to make the pharmacy acquisition that would change the trajectory of his career. As a third-generation pharmacist, his family has been in the industry for 60 years, and Gandhi was thrilled to continue carrying on the family legacy. Gandhi shared that without Biz2Credit, he would not have been able to get his new pharmacy open and operating in a timely manner.

"I would recommend Biz2Credit to any business owner in any industry. Their process was so simple and streamlined." Gandhi shared when asked if he would refer other business owners to Biz2Credit. So, what is next for this ambitious pharmacy owner? Gandhi shared that by providing him with the financing to acquire Scotch Plains Pharmacy, Biz2Credit opened many doors for him and his family down the road.

Gandhi shared that his biggest piece of advice for other business owners is that it is vital you are aware of the industry regulations surrounding your field and to ensure you have a genuine interest in both your business offerings and customer experience.

Are you the owner of a pharmacy and looking to learn more about the different small business financing that are available to your business? Check out this in-depth guide examining the different types of small business loans for pharmacies. Or are you an entrepreneur curious about opening your own pharmacy? This in-depth blog article from Biz2Credit explains the cost of opening a pharmacy. Or, if you are a current pharmacy owner and you a small business owner seeking additional financing to help meet your business goals? Contact a Biz2Credit Finance Expert today!