About the Biz2Credit Top Small Business Industries Study

Biz2Credit, a leading online funding provider to small businesses, analyzed the financial performance of over 30,000 applications submitted through the company’s online funding platform from January 2021 to December 2021. All companies included in the Biz2Credit study have less than 250 employees and less than $10 million in annual revenues. The report covers small businesses across the country, from start-ups to established companies.

In addition, this year’s report analyzed lending data based on the Small Business Administration’s database. The objective of the study is to identify the top industries for small businesses during the preceding year and to measure the performance of businesses based on their industry affiliation.

INSIGHT FROM BIZ2CREDIT CEO, ROHIT ARORA

Executive Summary

According to the Biz2Credit 2022 Top Small Business Industry Report, the industry that led once again in key performance categories is Information Technology (IT). IT companies received the highest approval rate for funding requests, highest average funded amount, and maintained the highest average credit score and highest average revenue. In other key categories, Retail Trade received the highest volume of funding.

The Biz2Credit Small Business Recovery Ranking found that businesses in the Financial and Insurance industries recovered the fastest from the COVID-19 pandemic. The ranking is a proprietary measure of demand for financing and an industry’s need for government-provided relief that was made available through the CARES Act and subsequent government fiscal stimulus during 2020 and 2021.

Key Findings: Summary

The industry with the highest approval rate for all financing applications was Information Technology at 41%.

Information Technology had the most established companies with an average age of 7.4 years

Transportation and Warehousing had the highest rate of startups with an average age of 3.9 years.

The Industry with the highest volume of funding was Retail Trade which contributed 27.7%

The industry with the highest average credit score was Information Technology at 658.

The industry with the highest average revenue was Information Technology at $955,793

The industry with the highest average funding was Information Technology at $131,743

Top Industries Based On Approval Rates

Information Technology had the highest approval rate* for all financing applications at 41%, followed by Accommodation and Food Service and Health Care & Social Assistance at 38% and Manufacturing at 36%.

Information Technology

Highest

Approval Rate

Top Industries Based On Age of Business

Information Technology was the most established industry with an average age of 7.4 years, followed by Manufacturing (7.1 years) and Agriculture, Forestry, Fishing and Hunting (6.8 years).

Transportation and Warehousing was the industry with the highest rate of startups with an average age of 3.9 years.

Transportation and Warehousing

Highest rate

of startup

Information Technology

Most

established

Industry Highlights by Volume of Funding

Industry with the highest volume of funding* was Retail Trade at 27.7% followed by Health Care and Social Assistance (10.7%), Accommodation and Food Services (10.4%), and Other Services (10.4%)

*Highest Volume of Funding was determined by dividing the total industry amount of funding by the total funded amount in 2021.

Industry Highlights by Credit Score

The industry with the highest average credit score was Information Technology at 658, followed by Real Estate and Rental and Leasing, Manufacturing , and Professional/Scientific/Technological Services.

Industry Highlights by Average Revenue

The industry with the highest average revenue was Information Technology at $955,793 followed by Manufacturing and Wholesale Trade.

Industry Highlights by Average Funding

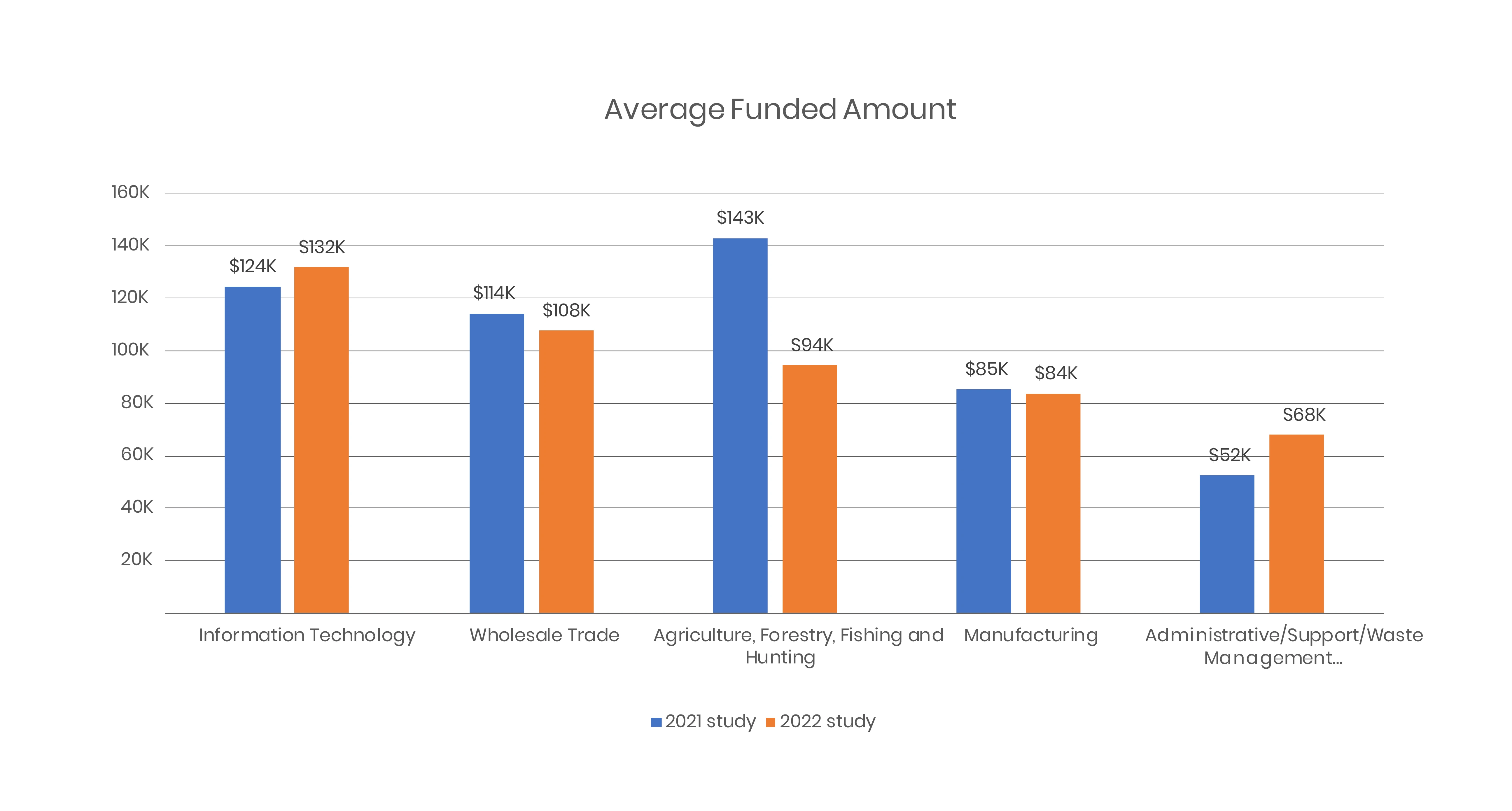

The top industries that received the highest average funded amount nationally were Information Technology at $131,743, Wholesale Trade, Agriculture/Forestry/Fishing/Hunting, Manufacturing, Administrative/Support/Waste Management, and Retail Trade.

| Industry | Average Funded Amount |

|---|---|

| Information Technology | $131,743 |

| Wholesale Trade | $107,576 |

| Agriculture, Forestry, Fishing and Hunting | $94,333 |

| Manufacturing | $83,700 |

| Administrative and Support and Waste Management and Remediation Services | $67,801 |

| Retail Trade | $67,031 |

Annual Trends Among Top Industries For Approval Rate

As an increasing number of businesses sought financing in the wake of the pandemic, there was a decline in the overall financing approval rates that businesses across many industries experienced, with some exceptions, notably Manufacturing.

In the 2022 study, Information technology had the highest approval rate at 41% (dropped from 50% in the 2021 study), followed by Accommodation and Food Service and Health Care and Social Assistance.

Annual Trends Among Top Industries For Average Credit Score

The FICO score for Top industries in the 2022 study decreased overall compared to the score in the 2021 study. This reflects the effects of two years of pandemic-affected economic performance as business owners have sought credit in higher numbers.

The highest FICO score still goes to Information Technology with a score of 658.

Annual Trends Among Top Industries For Average Revenue

From a year over year comparison, the average revenue for top industries remained similar, Information Technology remained the 1st highest average revenue with slight growth of 1.3% followed by Manufacturing and Wholesale Trade.

Annual Trends Among Top Industries For Average Funded Amount

Information Technology was the highest average funded amount with a 6% growth year over year, followed by Wholesale Trade and Agriculture/Forestry/Fishing/Hunting which showed a drop of 6% and 34% respectively.

Recovery Ranking Across Industries : Top 10

Industries that had a high demand for credit, but low levels of distress were Finance and Insurance, Agriculture, Forestry, Fishing and Hunting and Utilities.

A Recovery Ranking above 50% is considered a sign of strong economic recovery for an industry.

| Rank-Recovery | Industry | Recovery % |

| 1 | Finance and Insurance | 76% |

| 2 | Agriculture, Forestry, Fishing and Hunting | 76% |

| 3 | Utilities | 74% |

| 4 | Retail Trade | 71% |

| 5 | Administrative and Support and Waste Management and Remediation Services | 71% |

| 6 | Other Services (except Public Administration) | 70% |

| 7 | Real Estate and Rental and Leasing | 69% |

| 8 | Management of Companies and Enterprises | 69% |

| 9 | Transportation and Warehousing | 68% |

| 10 | Construction | 67% |

The Biz2Credit Recovery Ranking Matrix

The Biz2Credit Recovery Ranking was based on demand for small business credit and SBA Data (PPP loan approvals) for all the industries measured. Industries that had a high demand for credit, but low levels of distress were Finance and Insurance, Retail Trade, Administrative and Support and Waste Management and Remediation, and Real Estate.

About Biz2Credit

Founded in 2007, Biz2Credit has arranged more than $7 billion in small business financing. The company is expanding its industry-leading technology in custom digital platform solutions for banks and other financial institutions, investors, and service providers. Visit

www.biz2credit.com or

Twitter @Biz2Credit, Facebook, and LinkedIn