Fast and Flexible Medical Device Financing

to Keep Your Business Moving

Explore medical device financing and loans from Biz2Credit designed to meet your business’s needs.

Need Financing for Your Business?

Biz2Credit has commercial financing products, such as term loans and revenue-based financing, that help your business grow.

Apply OnlineSet up a Biz2Credit account and apply for business financing

Why Medical Equipment Businesses Need Reliable Financing?

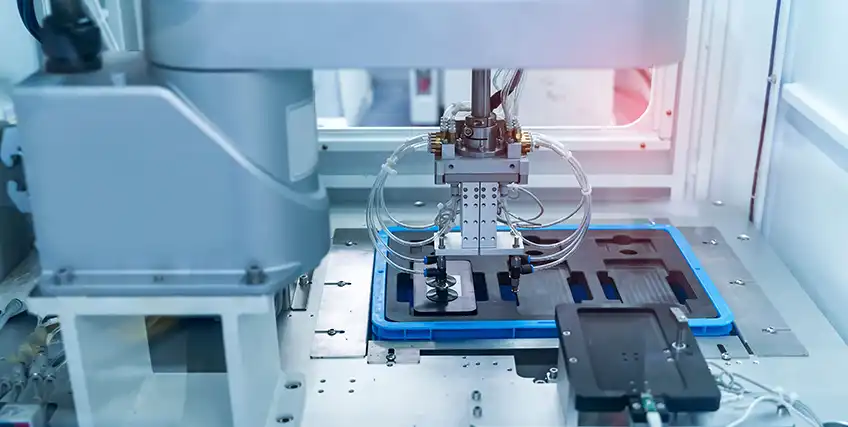

The medical equipment and supplies industry is essential for healthcare operations, but acquiring and maintaining high-quality medical devices comes with significant costs. Whether running a hospital equipment supply business or a medical device manufacturing company, access to medical device financing is crucial to ensure smooth operations.

Many business owners explore healthcare equipment financing to afford cutting-edge diagnostic machines, surgical instruments, and treatment tools. Keeping up with the evolving healthcare landscape requires continuous investment in advanced technologies, but large upfront costs can create financial challenges.

For medical equipment businesses looking to scale production, upgrade facilities, or invest in research and development, securing medical equipment lending ensures sustainable growth. Financing solutions enable businesses to procure the latest healthcare technologies while maintaining operational stability.

Why Healthcare Equipment Businesses Rely on Biz2Credit for Flexible Funding?

Investing in high-quality medical equipment is necessary for healthcare providers, but the costs can be overwhelming. Medical device financing provides businesses with the capital required to invest in cutting-edge healthcare technology, ensuring they meet industry standards and maintain operational efficiency.

Biz2Credit offers financing solutions that fulfill healthcare equipment financing needs with a seamless application process and quick funding. Whether you need capital for large-scale equipment purchases, inventory expansion, or infrastructure development, our financing solutions provide flexibility for business owners.

For those searching for medical equipment lending, Biz2Credit ensures fast funding, competitive terms, and a simple process. With our expert financial advisors and flexible repayment options, businesses can focus on supplying top-tier healthcare equipment while maintaining financial stability.

Our Strengths:

- Repayment Simplicity We have simple repayment options for medical device financing with flexible repayment terms. See your payment schedule and make payments any time in your Biz2Credit account.

- Dedicated Funding Specialists Consult a funding specialist to determine what financing options fit your business best or get help at any time along the way as you complete our online funding application.

How Medical Device Financing Supports Business Growth?

Medical device businesses require significant capital to supply hospitals, clinics, and healthcare providers with cutting-edge equipment. Medical device financing helps businesses acquire essential healthcare tools without the burden of large upfront costs.

For businesses considering doctor equipment loans, financing provides an avenue to purchase high-end diagnostic machines, treatment devices, and surgical tools. Healthcare providers demand the best technology, making equipment financing an essential part of industry success.

The ability to access hospital equipment financing allows businesses to invest in inventory, upgrade their facilities, and improve production capabilities. With flexible financing solutions, medical equipment suppliers can continue innovating and meeting the needs of the healthcare sector.

Explore Flexible Medical Device Financing Solutions

1. Term Loans

Expanding a medical equipment business often requires significant capital to purchase state-of-the-art devices, upgrade technology, or scale production. Term loans provide businesses with a structured funding solution to cover these high-cost investments. Though this type of financing is not exactly medical device financing, but it can fulfill the same needs of a healthcare equipment financing.

With fixed repayment schedules and flexible loan amounts, term loans help businesses maintain financial stability while acquiring necessary equipment such as imaging machines, laboratory devices, or surgical tools. Even business owners exploring doctor equipment loans can rely on term loans to fund long-term projects without immediate financial strain.

Eligibility Criteria:

- A credit score of 650 and above.

- At least 18 months in business.

- Annual revenue of $250,000 or more.

2. Revenue-Based Financing

For businesses that rely on fluctuating revenue cycles, securing traditional loans can be challenging. Revenue-based financing offers an alternative that allows repayment based on business income rather than fixed monthly payments.

This funding model is ideal for medical suppliers and equipment manufacturers with variable sales patterns, enabling them to maintain cash flow while fulfilling large client orders. Those considering medical device financing can use revenue-based financing to support expansion, inventory purchases, or supply chain stability without rigid repayment terms.

Eligibility Criteria:

- A credit score of 575 and above.

- A minimum of 12 months in operation.

- Annual revenue of $250,000 or more.

3. Commercial Real Estate Loans

Medical equipment businesses often need dedicated production, storage, or distribution facilities to operate efficiently. A commercial real estate loan provides long-term financing to acquire, renovate, or expand business spaces, ensuring seamless production and supply chain management.

With this type of financing, businesses can invest in warehouse expansion, build research and development centers, or upgrade existing manufacturing sites to improve efficiency. Owning or expanding physical facilities allows medical equipment businesses to meet rising healthcare demands while positioning themselves for sustained growth.

Eligibility Criteria:

- A credit score of 650 and above.

- Minimum 18 months in business.

- Property as collateral.

- Annual revenue of $250,000 or more.

Benefits of Medical Device Financing

1. Acquire Cutting-Edge Medical Equipment Without Upfront Costs

Purchasing high-end medical devices such as MRI scanners, X-ray machines, or advanced surgical tools requires a substantial financial investment. Medical device financing allows businesses to acquire essential equipment without depleting their cash reserves. This type of funding can help medical businesses to spread out the cost over time, ensuring they can upgrade technology while maintaining financial stability. With flexible repayment structures, medical equipment suppliers and healthcare providers can invest in state-of-the-art tools to enhance patient care and streamline operations without financial burden.

2. Improve Cash Flow and Business Stability

Maintaining a steady cash flow is crucial for medical equipment businesses dealing with fluctuating supply chain costs or insurance reimbursements. Medical device financing provides quick access to funds, helping business owners cover expenses without disrupting operations.

3. Expand Production or Upgrade Manufacturing Facilities

Medical equipment manufacturers often require specialized facilities to develop and store their devices. Medical device financing ensures businesses can expand production lines, upgrade storage spaces, or invest in research facilities without delay. This type of financing solutions can support renovations, new facility construction, or larger distribution centers. Expanding a facility enhances productivity, ensures compliance with healthcare regulations, and positions businesses to meet increasing industry demand.

4. Maintain Regulatory Compliance and Safety Standards

The medical equipment industry is highly regulated, requiring businesses to meet strict compliance standards. Medical device financing allows manufacturers and suppliers to invest in certification processes, safety upgrades, and quality control systems without financial strain.

5. Scale Business Operations Without Delays

As demand for medical devices grows, businesses need access to capital to scale their operations effectively. Medical device financing enables companies to hire skilled employees, expand research capabilities, and streamline distribution processes.

How to Apply for Medical Device Financing?

Simple steps to secure medical device financing with Biz2Credit.

Inspiring Medical Equipment Companies Success Stories

Business Loan for Medical Device Financing

Loan For Medical Equipment and Supplies Business

Businesses in the medical industry, from private practices to specialized treatment centers and other healthcare providers, may need medical equipment to provide adequate patient care.

The Role of Medical Device Financing in Improving Patient Care Services

Working in healthcare can be lucrative and rewarding. You can earn a solid salary and make a tangible difference in the lives of your patients.

Run a Smoother Medical Billing Business with These Tips & KPIs

In the healthcare industry, running your own medical billing business isn’t just about sending invoices and collecting payments

FAQs on Medical Device Financing

1. Can medical device financing be used for used or refurbished equipment?

Medical device financing can be used to purchase both new and refurbished medical equipment, depending on the needs of your business. Many healthcare providers and equipment suppliers opt for high-quality refurbished machines to save costs while maintaining industry standards. Such financing solutions can help cover the cost of second-hand equipment, ensuring that companies can upgrade without significant upfront investment. Whether purchasing brand-new technology or pre-owned devices, financing allows businesses to acquire the necessary tools while managing expenses efficiently.

2. What types of medical businesses qualify for medical device financing?

A wide range of medical businesses can access medical device financing, including equipment manufacturers, distributors, private clinics, hospitals, and dental practices. Whether supplying imaging machines, surgical instruments, or patient monitoring systems, businesses in the healthcare industry often require financial support to maintain inventory and scale operations.

3. How does medical device financing compare to leasing equipment?

The primary difference between medical device financing and leasing is ownership. Financing allows businesses to purchase equipment outright, making them the full owner once payments are completed. In contrast, leasing provides temporary access to equipment but requires ongoing payments without ownership benefits.

4. Are there financing options available for small medical device businesses?

Medical device financing is available for small businesses, including independent suppliers, startups, and specialized healthcare equipment providers. While traditional loans may have strict requirements, alternative financing options cater to small businesses needing flexible funding.

5. Can medical device financing be used for software and digital healthcare tools?

Medical device financing is not just for physical equipment but can also cover software solutions essential for modern healthcare businesses. From electronic medical records (EMR) systems to advanced diagnostic software, financing can help medical providers integrate technology that enhances efficiency and patient care.

Frequent searches leading to this page

Term Loans are made by Itria Ventures LLC or Cross River Bank, Member FDIC. This is not a deposit product. California residents: Itria Ventures LLC is licensed by the Department of Financial Protection and Innovation. Loans are made or arranged pursuant to California Financing Law License # 60DBO-35839