The Role of Medical Device Financing in Improving Patient Care Services

April 01, 2025 | Last Updated on: April 02, 2025

Article Summary:

- Healthcare providers can look into different medical device financing options.

- Having new equipment can improve efficiency and patient care.

- Financing medical equipment is available through term loans, SBA loans, a business line of credit, or equipment financing.

Working in healthcare can be lucrative and rewarding. You can earn a solid salary and make a tangible difference in the lives of your patients. As part of running a medical practice, you need to keep attracting and caring for new patients, putting their comfort first. One way to do that is by using cutting edge medical technology that can improve the patient's experience and their satisfaction. Updating your office with the latest medical devices can be a win-win for everyone but paying for the latest equipment can come at a significant cost. For example, a new premium MRI machine could run you $500,000. That's where medical device financing can help.

What is Medical Device Financing?

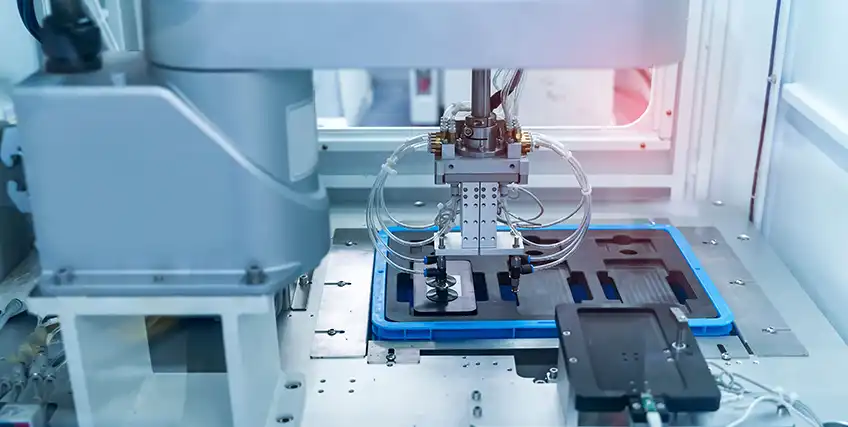

Medical device financing offers healthcare providers with financing options to purchase medical devices. New technologies continue to change the healthcare industry and improve the patient's experience. To stay competitive and up-to-date, healthcare professionals can consider adding new equipment. Typically, this can be a major investment and affect your cash flow if you pay out-of-pocket.

Medical device financing allows borrowers to secure funds to make equipment purchases now and repay over time.

How Medical Device Financing Can Improve Patient Care

Whether it's a routine medical exam or a follow-up for a serious health matter, one thing is clear: nobody really enjoys going to the doctor's or dentist's office or receiving medical care.

Putting the patient's experience first can help you stand out as a medical professional. To improve your patients' comfort levels and outcomes, having the latest medical devices can help.

Whether you need MRI machines, CT scanners, X-ray equipment, ultrasound equipment, or surgical tools, medical device financing can help you purchase various types of medical equipment.

The latest medical equipment can help with:

- Reducing errors

- Efficient testing

- Early detection

- Reliability and consistency

- Increased safety

- Patient satisfaction

- Real-time alerts

- Automated data entry

- Enhancing patient comfort

These benefits can transform patient care. If you have access to improved data and imaging, you can screen for abnormalities and diseases. Having the latest medical devices can streamline the process and provide faster processing times and more comfort. When that happens, patients are more likely to continue coming back. That not only helps your business needs but also can save lives.

Types of Medical Device Financing

Every medical professional or healthcare provider has different business needs. Some may have a specific amount they're looking to borrow, while others might want more flexibility. One doctor’s office might want to buy the equipment outright, while another wants to look into leasing options. Whatever your needs are, there are different equipment financing solutions available.

Term Loans

Term loans are a great option to secure a large amount of capital upfront. Seeing as medical equipment can easily set you back six figures, term loans can help by providing a lump sum of money. As a borrower, you repay term loans on a fixed term.

Term loans can have either fixed or variable interest rates. Fixed interest rates are attractive as they lead to stable and predictable payments, which makes it easier to budget. Repayment terms vary by lender.

Business Line of Credit

If you're not quite sure how much you need in medical device financing, a business line of credit can help. You can have flexible financing and get approved for a specific line of credit amount. You're free to use whatever you want up to that limit. Interest only accrues on what you borrow.

A business line of credit is more similar to a credit card than a traditional business loan. As you pay down what you borrow, the available credit opens up and is available to use again.

Equipment Financing

Medical equipment financing can come in two forms: equipment loans or equipment leases. The equipment you purchase is collateral for the loan. When going the equipment loan route, you typically need to put up a 10% to 20% down payment. Equipment leasing allows you to get the medical devices you need without purchasing it outright. You typically have two equipment leasing options:

- Capital lease: Consider this more of a rent-to-own option which allows you to make rental payments over a term. At the end of the term, you may have a $1.00 buyout to purchase the equipment.

- Operating lease: This is more of a traditional rental agreement, which offers you more flexibility. You can return the equipment at the end of the term, may renew your rental or have the opportunity to purchase the equipment.

The Small Business Administration (SBA)

As a medical practice owner or healthcare provider, your focus is on the patients. But if you're running the show, you also have to focus on the business aspect of it as well. That can include getting medical device financing to make sure you have state-of-the-art equipment in your office. One place to look is through the Small Business Administration (SBA), which offers federally backed small business loans.

The SBA 7(a) loan program allows you to use funds for equipment, supplies, furniture and working capital. SBA 504 loans are available for long-term machinery and equipment that last a minimum of 10 years.

While SBA offers helpful financing programs, be aware that processing and funding times may be longer than other options.

What to Consider

If you're looking into medical device financing, the application process for each of these options will vary. Your creditworthiness will come into play and will affect the interest rates you qualify for. Consider your total monthly payments and interest charges and review repayment terms before going with one option.

Final Thoughts

As a healthcare professional, you want to stay on top of your game and serve your patients well. Having the latest medical devices and equipment can make everything more comfortable for patients. That means they're likely to come back and you'll have the right equipment to help diagnose, manage, and treat a number of conditions. Medical device financing can give you the capital you need to purchase the right equipment and improve patient care.

FAQs about Medical Device Financing

If you have additional questions about medical device financing, here are frequently asked questions and answers to help you get started.

What Credit Score Do You Need for Medical Equipment Financing?

Every medical device financing lender will have different credit score requirements. In general, many want to see a minimum credit score of 650 or higher.

What Are Medical Equipment Financing Rates?

Medical equipment financing interest rates depend largely on the lender, your credit score, and time in business. Though each lender has different interest rates, a ballpark range is 6% to 12%.

Can You Get Hospital Equipment Financing?

Hospitals can look into medical equipment leasing and medical equipment loans to help cover the costs of these major expenses.

Does Medical Device Financing Require a Down Payment?

Many medical equipment loans require a down payment of 10% to 20%. However, some lenders may offer 100% financing with no down payment requirements.

Can You Get Business Loans for a Medical Practice?

It's possible to get business loans for a medical practice from a traditional bank. Banks may call these medical practice loans which can help get you started. You can also look into medical device financing to meet your equipment needs.